Meet our Preferred Mortgage Lenders

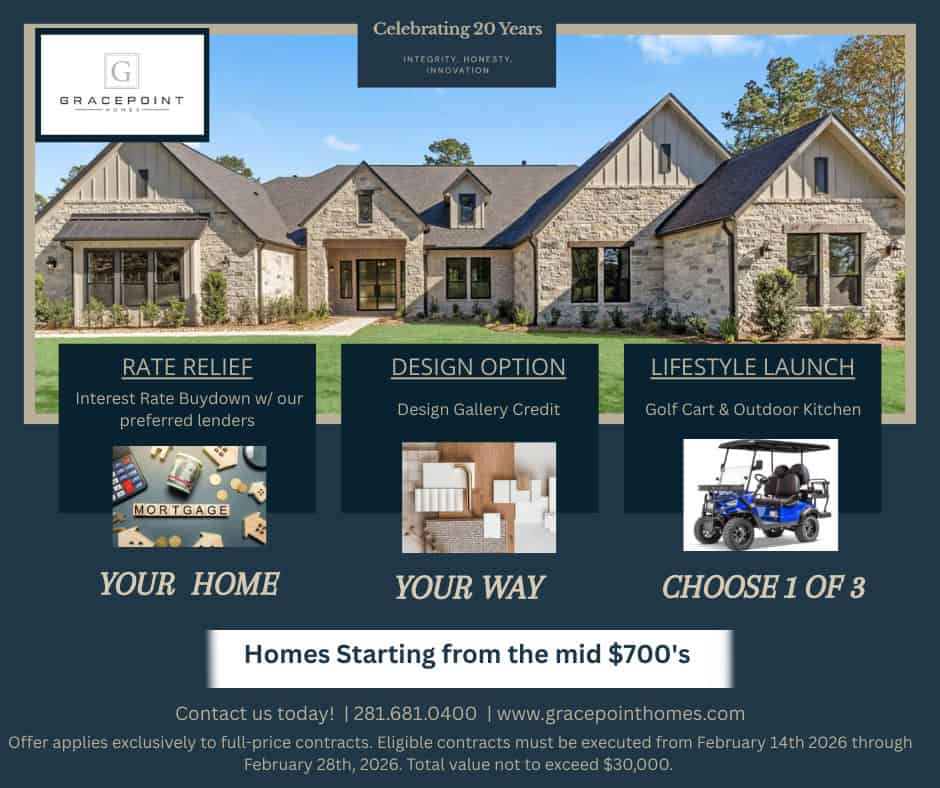

Here at Gracepoint Homes, we know getting your new home financed is an important step in the building experience. Being prepared will help make the process much easier. To make sure everything runs smoothly, Gracepoint Homes partners with several preferred mortgage lenders who understand the loan process and the local market.

Kelsey Majstorovic

Nations Lending

New Home Mortgage Specialist

Kelsey.Maj@nationslending.com

LoansByKelsey.com

Maddie Romero

Guild Mortgage

New Home Mortgage Specialist

maddie.romero@guildmortgage.net

mortgagemaddie.com